OK OTC 921 2008 free printable template

Show details

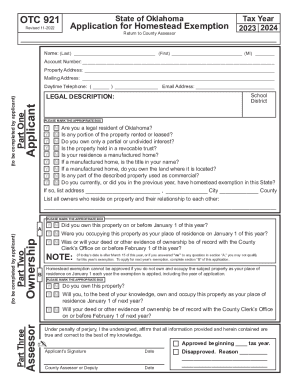

OTC Form revised 5-2008 921 Part One County: Name: Application for Homestead Exemption AccountNumber: DaytimeTelephone:() Oklahoma tax year PropertyAddress: MailingAddress: (to be completed by applicant)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your homestead form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homestead form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homestead form online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit homestead form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

OK OTC 921 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out homestead form

How to fill out homestead form:

01

Start by gathering all the required documents and information. This includes your identification, proof of residency, and any relevant financial records.

02

Carefully read through the instructions provided with the homestead form. Make sure you understand all the requirements and sections of the form.

03

Begin filling out the form, starting with your personal information such as your name, address, and contact details.

04

Provide any necessary details about your property, including its location, size, and ownership information.

05

If applicable, include information about any exemptions you may be eligible for, such as senior or disability exemptions.

06

Double-check all the information you have entered to ensure accuracy and completeness.

07

Sign the form, following any specific instructions provided.

08

Make copies of the completed homestead form for your records before submitting it to the relevant authority.

Who needs homestead form:

01

Homeowners who want to claim a homestead exemption on their property taxes.

02

Individuals or families who are looking to protect their primary residence from creditors.

03

Homeowners who want to establish their property as a homestead for legal purposes, such as in estate planning or to protect it from certain legal claims.

Fill form : Try Risk Free

People Also Ask about homestead form

Who qualifies for homestead exemption in Oklahoma?

How do you become exempt from property taxes in Oklahoma?

How long do you have to pay property taxes in Oklahoma?

What is the purpose of homestead exemption Oklahoma?

Who are exempted from paying real property tax?

How do I homestead My house in Oklahoma?

What is considered a homestead in Oklahoma?

What qualifies as a homestead in Oklahoma?

Who qualifies for homestead exemption in Oklahoma?

Who is exempt from paying property taxes in Oklahoma?

How do you qualify for homestead exemption in Oklahoma?

What age do you stop paying property taxes in Oklahoma?

How much does homestead exemption save you in Oklahoma?

Who is exempt from property taxes in Oklahoma?

At what age do you stop paying property tax in Oklahoma?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

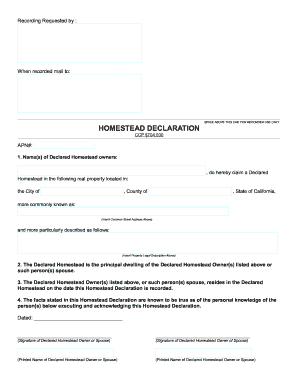

What is homestead form?

A homestead form is a legal document used to establish a homestead exemption on a residential property. A homestead exemption is a benefit provided by some states that allows homeowners to partially or fully exempt a portion of their property's value from property taxes. The homestead form typically requires the property owner to provide certain information about the property, such as its address and legal description, as well as personal information about the homeowner, such as their name, Social Security number, and date of birth. The form may also require the homeowner to declare that they meet certain eligibility requirements for the homestead exemption, such as being the primary resident of the property. The completed form is typically submitted to the local tax assessor's office or another relevant government agency for processing.

Who is required to file homestead form?

The requirement to file a homestead form varies depending on the jurisdiction. In general, homeowners who meet certain eligibility criteria may be eligible to file a homestead exemption form. This could include primary residents, disabled individuals, senior citizens, and veterans, among others, depending on the specific laws and regulations of the state or country. It is advisable to consult with local authorities or a real estate professional to determine the specific eligibility requirements and filing procedures for a homestead form in a specific area.

How to fill out homestead form?

To fill out a homestead form, follow these steps:

1. Obtain the homestead form: The form is typically available from your local county recorder's office, assessor's office, or online on the official website of your state's Department of Revenue or Taxation.

2. Read and understand the instructions: Familiarize yourself with the form’s instructions before filling it out. These instructions will provide important information about what information is needed and how to complete each section.

3. Provide personal information: Start by entering your full legal name, address, phone number, and email address. You might also need to provide your Social Security number and date of birth.

4. Declare primary residence: Indicate whether the property in question is your primary residence or not. In most cases, homestead exemptions are only available for primary residences.

5. Describe the property: Provide the property's full address, legal description, and parcel number. This information can typically be found on your property tax statement or deed.

6. Provide additional owner information: If you co-own the property with others, include their names, contact details, and their share of ownership.

7. Sign and date the form: Once you have completed all the necessary sections, sign and date the form. If there are multiple property owners, each one should sign the form.

8. Submit the form: Follow the instructions provided on the form to know where and how to submit it. This may include mailing the form to the appropriate government office, submitting it online, or delivering it in person.

It's important to note that homestead exemption forms and requirements can vary between states and counties. Therefore, ensure that you are using the correct form for your locality and review any additional requirements that may be specific to your area. If you are unsure about any aspect of the form, consider consulting with a local attorney or contacting your county recorder or assessor's office for guidance.

What is the purpose of homestead form?

The purpose of a homestead form is to establish and protect a homestead exemption. A homestead exemption is a legal provision that exists in some jurisdictions, primarily in the United States, which grants certain benefits and protections to homeowners. By filing a homestead form, homeowners can declare their property as their primary residence and benefit from exemptions that may include property tax reductions, creditor protection, exemption from certain debts, and protection from forced sale in certain circumstances. The specific purpose and benefits of a homestead form may vary depending on the state or jurisdiction in which it is filed.

What information must be reported on homestead form?

The specific information required on a homestead form can vary depending on the jurisdiction. However, some common information that may be required includes:

1. Personal information: This includes the names, addresses, and contact information of the property owner(s) or homestead claimants.

2. Property details: This includes the address and legal description of the property that is being claimed as a homestead.

3. Declaration of homestead: The form typically requires a declaration stating that the property is the primary residence of the claimant(s) and is intended to be their permanent residence.

4. Marital status: Some jurisdictions may require information about the marital status of the claimant(s) or whether the property is jointly owned.

5. Exemptions and exemptions value: The form may ask for information on any exemptions that the claimant(s) may be entitled to, such as exemptions for age or disability. Additionally, if there is a limit on the value of property that can be exempted, the form may require the value of the property to be reported.

6. Supporting documentation: Depending on the jurisdiction, additional supporting documentation may be required, such as proof of residency, copies of tax returns, or proof of ownership.

It is important to consult the specific homestead form for the jurisdiction in question to ensure that all required information is provided accurately.

What is the penalty for the late filing of homestead form?

The penalty for late filing of a homestead form can vary depending on the jurisdiction. In some cases, there may be a fixed monetary penalty, such as a fine or a late fee, which could range from a few dollars to several hundred dollars. In other cases, there may be a percentage-based penalty, where the penalty is calculated based on a percentage of the assessed value of the property or a percentage of the taxes owed. It is important to check the specific laws and regulations of your jurisdiction to determine the exact penalty for late filing of the homestead form.

How can I get homestead form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the homestead form in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I fill out homestead form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your homestead form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete homestead form on an Android device?

Use the pdfFiller Android app to finish your homestead form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your homestead form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.